Enabling

Founded in Paris in 1961, the OCIM Group, owned and managed by the holding company OCIM Finance SA, has long experience of managing and financing tangible assets.

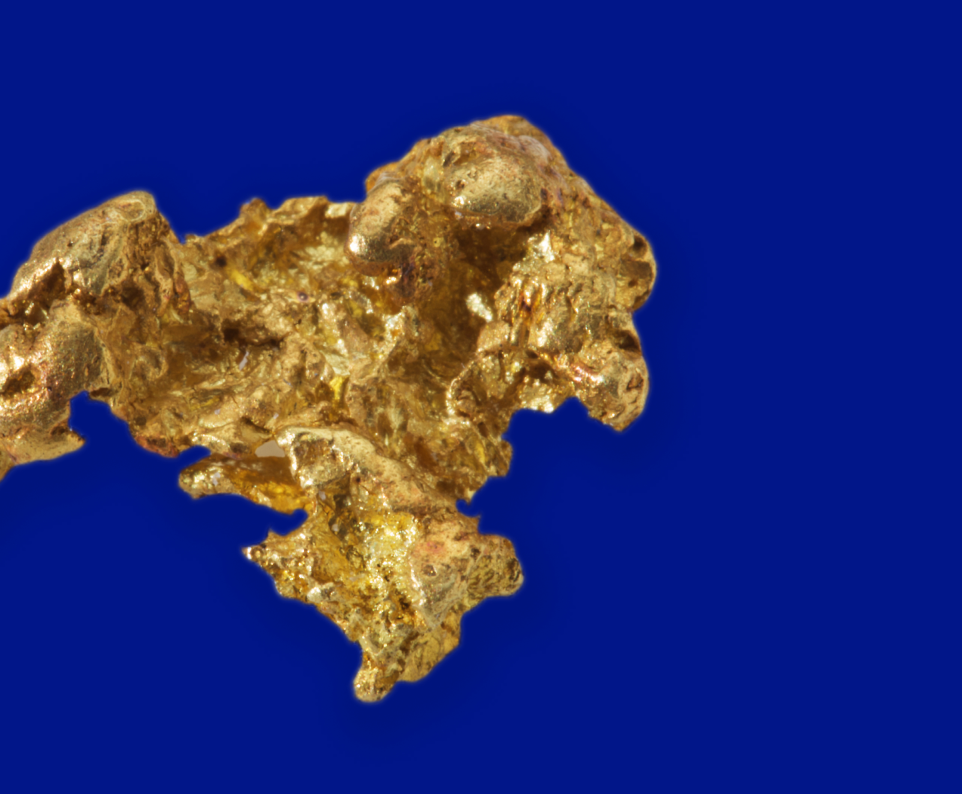

In addition to its historic real estate business, OCIM has diversified into other tangible assets considered strategic, in particular precious metals such as gold, silver, platinum and palladium, by carrying out a dual and complementary activity as a trader and financier. As a trader, OCIM buys and sells throughout the value chain of the assets concerned, from producers to end users. As a financier, OCIM finances the operations of the value chain, mainly through prepayment contracts. The subsidiary OCIM Metals & Mining SA carries all the financing and absorbs the credit risks.

The trading subsidiary electrum SA absorbs market risks such as commodity fluctuations and exchange rate risks. OCIM has teams based mainly in Paris and Geneva.

Our value proposition relies on a strong conviction

At a time when the transformation and the decarbonation of the economy requires efficient and stable metals markets, the mining industry relies on complex and lengthy production cycles. Bank financing is becoming scarce in that industry, calling for new sources of capital. This leads to the emergence of innovative structured financing solutions that must be both sustainable and tailor-made.

What makes us different?

Holistic project analysis capacity

Bespoke and flexible funding solutions

Fair value sharing with our partners

Accuracy and speed of execution

Focus on local human realities

A diversified and experienced team

OCIM is led by seasoned professionals who combine strategic vision and industry expertise